LLAMMA

LLAMMA is the market-making contract that rebalances the collateral. This contract is responsible for liquidating and de-liquidating collateral through arbitragurs. Every market has its own AMM (created from a blueprint) containing the collateral and borrowable asset.

When creating a new loan, the Controller evenly deposits the provided collateral by the user across a specified number of bands within the AMM, each representing a range of collateral prices, and mints stablecoins if it is a minting market or transfers the borrowed assets if it is a lending maket to the user. Withdrawing collateral is also done through the Controller.

In-Depth Overview

For a more technical and detailed overview of the entire system, see here: https://github.com/chanhosuh/curvefi-math/blob/master/LLAMMA.ipynb

The main concept behind LLAMMA:

"Conceptually, the main idea is that LLAMMA always skews the prices like a "taker", someone who pays for immediacy of trade execution by "crossing the spread", i.e. buys above the market mid and sells below the market mid. Of course, a smart contract cannot execute anything without an EOA triggering a transaction, so the way this works in practice is that LLAMMA sets the prices like a taker and relies upon arbitrageurs to "arb" the price back to market (oracle price)."1

In simple words: LLAMMA automatically converts collateral into crvUSD as the collateral price decreases, and vice versa, converts crvUSD back into the collateral asset when prices rise. Due to this, there is no instant hard-liquidation when certain collateral prices are reached, but during the soft-liquidation process, losses occur and consequently decrease the health of a loan. When the health drops below 0%, the user is eligible for hard-liquidation. The user's collateral can be sold off, and the position will be closed (just as in regular liquidations).

Disclaimer: Losses in Soft-Liquidation

When a position is in soft-liquidation, losses occur due to the "rebalancing" of collateral and borrowed asset within the bands of the AMM on the way down (converting collateral for borrowed asset) and on the way up (converting borrowed asset back to the collateral asset). These losses cannot numerically be quantified and are heavily dependent on the number of bands used for the loan and generally how efficient the arbitrage was.

LTV Ratio

The loan-to-value (LTV) ratio depends on the number of bands N and the parameter A. The higher the number of bands, the lower the LTV. More on bands here.

The loan discount is the percentage used to discount the collateral for calculating the maximum borrowable amount when creating a loan.

LTV

Example: At the time of writing, the wBTC market has a loan discount of 9% and a A value of 100.

\(\text{LTV (4 bands)} = \text{100%} - \text{9%} - 100 * \frac{4}{2*100} = \text{89%}\)

\(\text{LTV (50 bands)} = \text{100%} - \text{9%} - 100 * \frac{50}{2*100} = \text{66%}\)

Liquidation Range

The start of the liquidation range is also determined by the LTV:

To obtain the acutal the starting price value in dollars, one must multiply the value by the price_oracle at the time when creating the loan.

| Glossary | Description |

|---|---|

ticks, bands | Price ranges where liquidity is deposited. |

x | Coin which is being borrowed, typically a stablecoin. |

y | Collateral coin. |

A | Amplification, the measure of how concentrated the tick is. |

rate | Interest rate. |

rate_mul | Rate multiplier, 1 + integral(rate * dt). |

active_band | Current band. Other bands are either in one or the other coin, but not both. |

min_band | Bands below this are definitely empty. |

max_band | Bands above this are definitely empty. |

bands_x[n], bands_y[n] | Amounts of coin x or y deposited in band n. |

user_shares[user,n] / total_shares[n] | Fraction of the n'th band owned by a user. |

p_oracle | External oracle price (can be from another AMM). |

p (as in get_p) | Current price of AMM. It depends not only on the balances (x,y) in the band and active_band, but also on p_oracle. |

p_current_up, p_current_down | The value of p at constant p_oracle when y=0 or x=0 respectively for the band n. |

p_oracle_up, p_oracle_down | Edges of the band when p=p_oracle (steady state), happen when x=0 or y=0 respectively, for band n. |

Depositing and Withdrawing Collateral¶

Depositing and withdrawing collateral can only be done by the admin of the AMM, the Controller.

- Collateral is put into bands by calling

deposit_range()whenever someone creates a new loan or adds collateral to the existing position. - Collateral is removed by calling

withdraw().

deposit_range¶

AMM.deposit_range(user: address, amount: uint256, n1: int256, n2: int256):

Guarded Method

This function is only callable by the admin of the contract, which is the Controller.

Function to deposit collateral amount for user in the range of bands between n1 and n2.

Emits: Deposit

| Input | Type | Description |

|---|---|---|

user | address | User address. |

amount | uint256 | Amount of collateral to deposit. |

n1 | int256 | Lower band in the deposit range. |

n2 | int256 | Upper band in the deposit range. |

Source code

event Deposit:

provider: indexed(address)

amount: uint256

n1: int256

n2: int256

@external

@nonreentrant('lock')

def deposit_range(user: address, amount: uint256, n1: int256, n2: int256):

"""

@notice Deposit for a user in a range of bands. Only admin contract (Controller) can do it

@param user User address

@param amount Amount of collateral to deposit

@param n1 Lower band in the deposit range

@param n2 Upper band in the deposit range

"""

assert msg.sender == self.admin

user_shares: DynArray[uint256, MAX_TICKS_UINT] = []

collateral_shares: DynArray[uint256, MAX_TICKS_UINT] = []

n0: int256 = self.active_band

# We assume that n1,n2 area already sorted (and they are in Controller)

assert n2 < 2**127

assert n1 > -2**127

n_bands: uint256 = unsafe_add(convert(unsafe_sub(n2, n1), uint256), 1)

assert n_bands <= MAX_TICKS_UINT

y_per_band: uint256 = unsafe_div(amount * COLLATERAL_PRECISION, n_bands)

assert y_per_band > 100, "Amount too low"

assert self.user_shares[user].ticks[0] == 0 # dev: User must have no liquidity

self.user_shares[user].ns = unsafe_add(n1, unsafe_mul(n2, 2**128))

lm: LMGauge = self.liquidity_mining_callback

# Autoskip bands if we can

for i in range(MAX_SKIP_TICKS + 1):

if n1 > n0:

if i != 0:

self.active_band = n0

break

assert self.bands_x[n0] == 0 and i < MAX_SKIP_TICKS, "Deposit below current band"

n0 -= 1

for i in range(MAX_TICKS):

band: int256 = unsafe_add(n1, i)

if band > n2:

break

assert self.bands_x[band] == 0, "Band not empty"

y: uint256 = y_per_band

if i == 0:

y = amount * COLLATERAL_PRECISION - y * unsafe_sub(n_bands, 1)

total_y: uint256 = self.bands_y[band]

# Total / user share

s: uint256 = self.total_shares[band]

ds: uint256 = unsafe_div((s + DEAD_SHARES) * y, total_y + 1)

assert ds > 0, "Amount too low"

user_shares.append(ds)

s += ds

assert s <= 2**128 - 1

self.total_shares[band] = s

total_y += y

self.bands_y[band] = total_y

if lm.address != empty(address):

# If initial s == 0 - s becomes equal to y which is > 100 => nonzero

collateral_shares.append(unsafe_div(total_y * 10**18, s))

self.min_band = min(self.min_band, n1)

self.max_band = max(self.max_band, n2)

self.save_user_shares(user, user_shares)

log Deposit(user, amount, n1, n2)

if lm.address != empty(address):

lm.callback_collateral_shares(n1, collateral_shares)

lm.callback_user_shares(user, n1, user_shares)

withdraw¶

AMM.withdraw(user: address, frac: uint256) -> uint256[2]:

Guarded Method

This function is only callable by the admin of the contract, which is the Controller.

Function to withdraw liquidity for user.

Emits: Withdraw

| Input | Type | Description |

|---|---|---|

user | address | User address. |

frac | uint256 | Fraction to withdraw (1e18 = 100%). |

Source code

event Withdraw:

provider: indexed(address)

amount_borrowed: uint256

amount_collateral: uint256

@external

@nonreentrant('lock')

def withdraw(user: address, frac: uint256) -> uint256[2]:

"""

@notice Withdraw liquidity for the user. Only admin contract can do it

@param user User who owns liquidity

@param frac Fraction to withdraw (1e18 being 100%)

@return Amount of [stablecoins, collateral] withdrawn

"""

assert msg.sender == self.admin

assert frac <= 10**18

lm: LMGauge = self.liquidity_mining_callback

ns: int256[2] = self._read_user_tick_numbers(user)

n: int256 = ns[0]

user_shares: DynArray[uint256, MAX_TICKS_UINT] = self._read_user_ticks(user, ns)

assert user_shares[0] > 0, "No deposits"

total_x: uint256 = 0

total_y: uint256 = 0

min_band: int256 = self.min_band

old_min_band: int256 = min_band

old_max_band: int256 = self.max_band

max_band: int256 = n - 1

for i in range(MAX_TICKS):

x: uint256 = self.bands_x[n]

y: uint256 = self.bands_y[n]

ds: uint256 = unsafe_div(frac * user_shares[i], 10**18)

user_shares[i] = unsafe_sub(user_shares[i], ds) # Can ONLY zero out when frac == 10**18

s: uint256 = self.total_shares[n]

new_shares: uint256 = s - ds

self.total_shares[n] = new_shares

s += DEAD_SHARES # after this s is guaranteed to be bigger than 0

dx: uint256 = unsafe_div((x + 1) * ds, s)

dy: uint256 = unsafe_div((y + 1) * ds, s)

x -= dx

y -= dy

# If withdrawal is the last one - transfer dust to admin fees

if new_shares == 0:

if x > 0:

self.admin_fees_x += unsafe_div(x, BORROWED_PRECISION)

if y > 0:

self.admin_fees_y += unsafe_div(y, COLLATERAL_PRECISION)

x = 0

y = 0

if n == min_band:

if x == 0:

if y == 0:

min_band += 1

if x > 0 or y > 0:

max_band = n

self.bands_x[n] = x

self.bands_y[n] = y

total_x += dx

total_y += dy

if n == ns[1]:

break

else:

n = unsafe_add(n, 1)

# Empty the ticks

if frac == 10**18:

self.user_shares[user].ticks[0] = 0

else:

self.save_user_shares(user, user_shares)

if old_min_band != min_band:

self.min_band = min_band

if old_max_band <= ns[1]:

self.max_band = max_band

total_x = unsafe_div(total_x, BORROWED_PRECISION)

total_y = unsafe_div(total_y, COLLATERAL_PRECISION)

log Withdraw(user, total_x, total_y)

if lm.address != empty(address):

lm.callback_collateral_shares(0, []) # collateral/shares ratio is unchanged

lm.callback_user_shares(user, ns[0], user_shares)

return [total_x, total_y]

Exchange Methods¶

The AMM can be used to exchange tokens, just like in any other AMM. This is necessary, as positions are arbitraged by trades within the AMM.

exchange¶

AMM.exchange(i: uint256, j: uint256, in_amount: uint256, min_amount: uint256, _for: address = msg.sender) -> uint256[2]:

Function to exchange in_amount of token i for a minimum amount of _min_amount of token j.

Returns: amount of coins given in and out (uint256).

Emits: TokenExchange

| Input | Type | Description |

|---|---|---|

i | uint256 | Input coin index. |

j | uint256 | Output coin index. |

in_amount | uint256 | Amount of input coin to swap. |

min_amount | uint256 | Minimum amount of output coin to get. |

_for | address | Address to send coins to. Defaults to msg.sender. |

Source code

event TokenExchange:

buyer: indexed(address)

sold_id: uint256

tokens_sold: uint256

bought_id: uint256

tokens_bought: uint256

@external

@nonreentrant('lock')

def exchange(i: uint256, j: uint256, in_amount: uint256, min_amount: uint256, _for: address = msg.sender) -> uint256[2]:

"""

@notice Exchanges two coins, callable by anyone

@param i Input coin index

@param j Output coin index

@param in_amount Amount of input coin to swap

@param min_amount Minimal amount to get as output

@param _for Address to send coins to

@return Amount of coins given in/out

"""

return self._exchange(i, j, in_amount, min_amount, _for, True)

@internal

def _exchange(i: uint256, j: uint256, amount: uint256, minmax_amount: uint256, _for: address, use_in_amount: bool) -> uint256[2]:

"""

@notice Exchanges two coins, callable by anyone

@param i Input coin index

@param j Output coin index

@param amount Amount of input/output coin to swap

@param minmax_amount Minimal/maximum amount to get as output/input

@param _for Address to send coins to

@param use_in_amount Whether input or output amount is specified

@return Amount of coins given in and out

"""

assert (i == 0 and j == 1) or (i == 1 and j == 0), "Wrong index"

p_o: uint256[2] = self._price_oracle_w() # Let's update the oracle even if we exchange 0

if amount == 0:

return [0, 0]

lm: LMGauge = self.liquidity_mining_callback

collateral_shares: DynArray[uint256, MAX_TICKS_UINT] = []

in_coin: ERC20 = BORROWED_TOKEN

out_coin: ERC20 = COLLATERAL_TOKEN

in_precision: uint256 = BORROWED_PRECISION

out_precision: uint256 = COLLATERAL_PRECISION

if i == 1:

in_precision = out_precision

in_coin = out_coin

out_precision = BORROWED_PRECISION

out_coin = BORROWED_TOKEN

out: DetailedTrade = empty(DetailedTrade)

if use_in_amount:

out = self.calc_swap_out(i == 0, amount * in_precision, p_o, in_precision, out_precision)

else:

amount_to_swap: uint256 = max_value(uint256)

if amount < amount_to_swap:

amount_to_swap = amount * out_precision

out = self.calc_swap_in(i == 0, amount_to_swap, p_o, in_precision, out_precision)

in_amount_done: uint256 = unsafe_div(out.in_amount, in_precision)

out_amount_done: uint256 = unsafe_div(out.out_amount, out_precision)

if use_in_amount:

assert out_amount_done >= minmax_amount, "Slippage"

else:

assert in_amount_done <= minmax_amount and (out_amount_done == amount or amount == max_value(uint256)), "Slippage"

if out_amount_done == 0 or in_amount_done == 0:

return [0, 0]

out.admin_fee = unsafe_div(out.admin_fee, in_precision)

if i == 0:

self.admin_fees_x += out.admin_fee

else:

self.admin_fees_y += out.admin_fee

n: int256 = min(out.n1, out.n2)

n_start: int256 = n

n_diff: int256 = abs(unsafe_sub(out.n2, out.n1))

for k in range(MAX_TICKS):

x: uint256 = 0

y: uint256 = 0

if i == 0:

x = out.ticks_in[k]

if n == out.n2:

y = out.last_tick_j

else:

y = out.ticks_in[unsafe_sub(n_diff, k)]

if n == out.n2:

x = out.last_tick_j

self.bands_x[n] = x

self.bands_y[n] = y

if lm.address != empty(address):

s: uint256 = 0

if y > 0:

s = unsafe_div(y * 10**18, self.total_shares[n])

collateral_shares.append(s)

if k == n_diff:

break

n = unsafe_add(n, 1)

self.active_band = out.n2

log TokenExchange(_for, i, in_amount_done, j, out_amount_done)

if lm.address != empty(address):

lm.callback_collateral_shares(n_start, collateral_shares)

assert in_coin.transferFrom(msg.sender, self, in_amount_done, default_return_value=True)

assert out_coin.transfer(_for, out_amount_done, default_return_value=True)

return [in_amount_done, out_amount_done]

@internal

@view

def calc_swap_out(pump: bool, in_amount: uint256, p_o: uint256[2], in_precision: uint256, out_precision: uint256) -> DetailedTrade:

"""

@notice Calculate the amount which can be obtained as a result of exchange.

If couldn't exchange all - will also update the amount which was actually used.

Also returns other parameters related to state after swap.

This function is core to the AMM functionality.

@param pump Indicates whether the trade buys or sells collateral

@param in_amount Amount of token going in

@param p_o Current oracle price and ratio (p_o, dynamic_fee)

@return Amounts spent and given out, initial and final bands of the AMM, new

amounts of coins in bands in the AMM, as well as admin fee charged,

all in one data structure

"""

# pump = True: borrowable (USD) in, collateral (ETH) out; going up

# pump = False: collateral (ETH) in, borrowable (USD) out; going down

min_band: int256 = self.min_band

max_band: int256 = self.max_band

out: DetailedTrade = empty(DetailedTrade)

out.n2 = self.active_band

p_o_up: uint256 = self._p_oracle_up(out.n2)

x: uint256 = self.bands_x[out.n2]

y: uint256 = self.bands_y[out.n2]

in_amount_left: uint256 = in_amount

fee: uint256 = max(self.fee, p_o[1])

admin_fee: uint256 = self.admin_fee

j: uint256 = MAX_TICKS_UINT

for i in range(MAX_TICKS + MAX_SKIP_TICKS):

y0: uint256 = 0

f: uint256 = 0

g: uint256 = 0

Inv: uint256 = 0

dynamic_fee: uint256 = fee

if x > 0 or y > 0:

if j == MAX_TICKS_UINT:

out.n1 = out.n2

j = 0

y0 = self._get_y0(x, y, p_o[0], p_o_up) # <- also checks p_o

f = unsafe_div(A * y0 * p_o[0] / p_o_up * p_o[0], 10**18)

g = unsafe_div(Aminus1 * y0 * p_o_up, p_o[0])

Inv = (f + x) * (g + y)

dynamic_fee = max(self.get_dynamic_fee(p_o[0], p_o_up), fee)

antifee: uint256 = unsafe_div(

(10**18)**2,

unsafe_sub(10**18, min(dynamic_fee, 10**18 - 1))

)

if j != MAX_TICKS_UINT:

# Initialize

_tick: uint256 = y

if pump:

_tick = x

out.ticks_in.append(_tick)

# Need this to break if price is too far

p_ratio: uint256 = unsafe_div(p_o_up * 10**18, p_o[0])

if pump:

if y != 0:

if g != 0:

x_dest: uint256 = (unsafe_div(Inv, g) - f) - x

dx: uint256 = unsafe_div(x_dest * antifee, 10**18)

if dx >= in_amount_left:

# This is the last band

x_dest = unsafe_div(in_amount_left * 10**18, antifee) # LESS than in_amount_left

out.last_tick_j = min(Inv / (f + (x + x_dest)) - g + 1, y) # Should be always >= 0

x_dest = unsafe_div(unsafe_sub(in_amount_left, x_dest) * admin_fee, 10**18) # abs admin fee now

x += in_amount_left # x is precise after this

# Round down the output

out.out_amount += y - out.last_tick_j

out.ticks_in[j] = x - x_dest

out.in_amount = in_amount

out.admin_fee = unsafe_add(out.admin_fee, x_dest)

break

else:

# We go into the next band

dx = max(dx, 1) # Prevents from leaving dust in the band

x_dest = unsafe_div(unsafe_sub(dx, x_dest) * admin_fee, 10**18) # abs admin fee now

in_amount_left -= dx

out.ticks_in[j] = x + dx - x_dest

out.in_amount += dx

out.out_amount += y

out.admin_fee = unsafe_add(out.admin_fee, x_dest)

if i != MAX_TICKS + MAX_SKIP_TICKS - 1:

if out.n2 == max_band:

break

if j == MAX_TICKS_UINT - 1:

break

if p_ratio < unsafe_div(10**36, MAX_ORACLE_DN_POW):

# Don't allow to be away by more than ~50 ticks

break

out.n2 += 1

p_o_up = unsafe_div(p_o_up * Aminus1, A)

x = 0

y = self.bands_y[out.n2]

else: # dump

if x != 0:

if f != 0:

y_dest: uint256 = (unsafe_div(Inv, f) - g) - y

dy: uint256 = unsafe_div(y_dest * antifee, 10**18)

if dy >= in_amount_left:

# This is the last band

y_dest = unsafe_div(in_amount_left * 10**18, antifee)

out.last_tick_j = min(Inv / (g + (y + y_dest)) - f + 1, x)

y_dest = unsafe_div(unsafe_sub(in_amount_left, y_dest) * admin_fee, 10**18) # abs admin fee now

y += in_amount_left

out.out_amount += x - out.last_tick_j

out.ticks_in[j] = y - y_dest

out.in_amount = in_amount

out.admin_fee = unsafe_add(out.admin_fee, y_dest)

break

else:

# We go into the next band

dy = max(dy, 1) # Prevents from leaving dust in the band

y_dest = unsafe_div(unsafe_sub(dy, y_dest) * admin_fee, 10**18) # abs admin fee now

in_amount_left -= dy

out.ticks_in[j] = y + dy - y_dest

out.in_amount += dy

out.out_amount += x

out.admin_fee = unsafe_add(out.admin_fee, y_dest)

if i != MAX_TICKS + MAX_SKIP_TICKS - 1:

if out.n2 == min_band:

break

if j == MAX_TICKS_UINT - 1:

break

if p_ratio > MAX_ORACLE_DN_POW:

# Don't allow to be away by more than ~50 ticks

break

out.n2 -= 1

p_o_up = unsafe_div(p_o_up * A, Aminus1)

x = self.bands_x[out.n2]

y = 0

if j != MAX_TICKS_UINT:

j = unsafe_add(j, 1)

# Round up what goes in and down what goes out

# ceil(in_amount_used/BORROWED_PRECISION) * BORROWED_PRECISION

out.in_amount = unsafe_mul(unsafe_div(unsafe_add(out.in_amount, unsafe_sub(in_precision, 1)), in_precision), in_precision)

out.out_amount = unsafe_mul(unsafe_div(out.out_amount, out_precision), out_precision)

return out

@internal

@view

def calc_swap_in(pump: bool, out_amount: uint256, p_o: uint256[2], in_precision: uint256, out_precision: uint256) -> DetailedTrade:

"""

@notice Calculate the input amount required to receive the desired output amount.

If couldn't exchange all - will also update the amount which was actually received.

Also returns other parameters related to state after swap.

@param pump Indicates whether the trade buys or sells collateral

@param out_amount Desired amount of token going out

@param p_o Current oracle price and antisandwich fee (p_o, dynamic_fee)

@return Amounts required and given out, initial and final bands of the AMM, new

amounts of coins in bands in the AMM, as well as admin fee charged,

all in one data structure

"""

# pump = True: borrowable (USD) in, collateral (ETH) out; going up

# pump = False: collateral (ETH) in, borrowable (USD) out; going down

min_band: int256 = self.min_band

max_band: int256 = self.max_band

out: DetailedTrade = empty(DetailedTrade)

out.n2 = self.active_band

p_o_up: uint256 = self._p_oracle_up(out.n2)

x: uint256 = self.bands_x[out.n2]

y: uint256 = self.bands_y[out.n2]

out_amount_left: uint256 = out_amount

fee: uint256 = max(self.fee, p_o[1])

admin_fee: uint256 = self.admin_fee

j: uint256 = MAX_TICKS_UINT

for i in range(MAX_TICKS + MAX_SKIP_TICKS):

y0: uint256 = 0

f: uint256 = 0

g: uint256 = 0

Inv: uint256 = 0

dynamic_fee: uint256 = fee

if x > 0 or y > 0:

if j == MAX_TICKS_UINT:

out.n1 = out.n2

j = 0

y0 = self._get_y0(x, y, p_o[0], p_o_up) # <- also checks p_o

f = unsafe_div(A * y0 * p_o[0] / p_o_up * p_o[0], 10**18)

g = unsafe_div(Aminus1 * y0 * p_o_up, p_o[0])

Inv = (f + x) * (g + y)

dynamic_fee = max(self.get_dynamic_fee(p_o[0], p_o_up), fee)

antifee: uint256 = unsafe_div(

(10**18)**2,

unsafe_sub(10**18, min(dynamic_fee, 10**18 - 1))

)

if j != MAX_TICKS_UINT:

# Initialize

_tick: uint256 = y

if pump:

_tick = x

out.ticks_in.append(_tick)

# Need this to break if price is too far

p_ratio: uint256 = unsafe_div(p_o_up * 10**18, p_o[0])

if pump:

if y != 0:

if g != 0:

if y >= out_amount_left:

# This is the last band

out.last_tick_j = unsafe_sub(y, out_amount_left)

x_dest: uint256 = Inv / (g + out.last_tick_j) - f - x

dx: uint256 = unsafe_div(x_dest * antifee, 10**18) # MORE than x_dest

out.out_amount = out_amount # We successfully found liquidity for all the out_amount

out.in_amount += dx

x_dest = unsafe_div(unsafe_sub(dx, x_dest) * admin_fee, 10**18) # abs admin fee now

out.ticks_in[j] = x + dx - x_dest

out.admin_fee = unsafe_add(out.admin_fee, x_dest)

break

else:

# We go into the next band

x_dest: uint256 = (unsafe_div(Inv, g) - f) - x

dx: uint256 = max(unsafe_div(x_dest * antifee, 10**18), 1)

out_amount_left -= y

out.in_amount += dx

out.out_amount += y

x_dest = unsafe_div(unsafe_sub(dx, x_dest) * admin_fee, 10**18) # abs admin fee now

out.ticks_in[j] = x + dx - x_dest

out.admin_fee = unsafe_add(out.admin_fee, x_dest)

if i != MAX_TICKS + MAX_SKIP_TICKS - 1:

if out.n2 == max_band:

break

if j == MAX_TICKS_UINT - 1:

break

if p_ratio < unsafe_div(10**36, MAX_ORACLE_DN_POW):

# Don't allow to be away by more than ~50 ticks

break

out.n2 += 1

p_o_up = unsafe_div(p_o_up * Aminus1, A)

x = 0

y = self.bands_y[out.n2]

else: # dump

if x != 0:

if f != 0:

if x >= out_amount_left:

# This is the last band

out.last_tick_j = unsafe_sub(x, out_amount_left)

y_dest: uint256 = Inv / (f + out.last_tick_j) - g - y

dy: uint256 = unsafe_div(y_dest * antifee, 10**18) # MORE than y_dest

out.out_amount = out_amount

out.in_amount += dy

y_dest = unsafe_div(unsafe_sub(dy, y_dest) * admin_fee, 10**18) # abs admin fee now

out.ticks_in[j] = y + dy - y_dest

out.admin_fee = unsafe_add(out.admin_fee, y_dest)

break

else:

# We go into the next band

y_dest: uint256 = (unsafe_div(Inv, f) - g) - y

dy: uint256 = max(unsafe_div(y_dest * antifee, 10**18), 1)

out_amount_left -= x

out.in_amount += dy

out.out_amount += x

y_dest = unsafe_div(unsafe_sub(dy, y_dest) * admin_fee, 10**18) # abs admin fee now

out.ticks_in[j] = y + dy - y_dest

out.admin_fee = unsafe_add(out.admin_fee, y_dest)

if i != MAX_TICKS + MAX_SKIP_TICKS - 1:

if out.n2 == min_band:

break

if j == MAX_TICKS_UINT - 1:

break

if p_ratio > MAX_ORACLE_DN_POW:

# Don't allow to be away by more than ~50 ticks

break

out.n2 -= 1

p_o_up = unsafe_div(p_o_up * A, Aminus1)

x = self.bands_x[out.n2]

y = 0

if j != MAX_TICKS_UINT:

j = unsafe_add(j, 1)

# Round up what goes in and down what goes out

# ceil(in_amount_used/BORROWED_PRECISION) * BORROWED_PRECISION

out.in_amount = unsafe_mul(unsafe_div(unsafe_add(out.in_amount, unsafe_sub(in_precision, 1)), in_precision), in_precision)

out.out_amount = unsafe_mul(unsafe_div(out.out_amount, out_precision), out_precision)

return out

exchange_dy¶

AMM.exchange_dy(i: uint256, j: uint256, out_amount: uint256, max_amount: uint256, _for: address = msg.sender) -> uint256[2]:

Function to exchange a maximum amount of max_amount of input token j for a total of out_amount of output token j.

Returns: amount of coins given: in and out (uint256).

Emits: TokenExchange

| Input | Type | Description |

|---|---|---|

i | uint256 | Input coin index. |

j | uint256 | Output coin index. |

in_amount | uint256 | Amount of input coin to swap. |

min_amount | uint256 | Minimum amount of output coin to get. |

_for | address | Address to send coins to (defaults to msg.sender). |

Source code

event TokenExchange:

buyer: indexed(address)

sold_id: uint256

tokens_sold: uint256

bought_id: uint256

tokens_bought: uint256

@external

@nonreentrant('lock')

def exchange_dy(i: uint256, j: uint256, out_amount: uint256, max_amount: uint256, _for: address = msg.sender) -> uint256[2]:

"""

@notice Exchanges two coins, callable by anyone

@param i Input coin index

@param j Output coin index

@param out_amount Desired amount of output coin to receive

@param max_amount Maximum amount to spend (revert if more)

@param _for Address to send coins to

@return Amount of coins given in/out

"""

return self._exchange(i, j, out_amount, max_amount, _for, False)

@internal

def _exchange(i: uint256, j: uint256, amount: uint256, minmax_amount: uint256, _for: address, use_in_amount: bool) -> uint256[2]:

"""

@notice Exchanges two coins, callable by anyone

@param i Input coin index

@param j Output coin index

@param amount Amount of input/output coin to swap

@param minmax_amount Minimal/maximum amount to get as output/input

@param _for Address to send coins to

@param use_in_amount Whether input or output amount is specified

@return Amount of coins given in and out

"""

assert (i == 0 and j == 1) or (i == 1 and j == 0), "Wrong index"

p_o: uint256[2] = self._price_oracle_w() # Let's update the oracle even if we exchange 0

if amount == 0:

return [0, 0]

lm: LMGauge = self.liquidity_mining_callback

collateral_shares: DynArray[uint256, MAX_TICKS_UINT] = []

in_coin: ERC20 = BORROWED_TOKEN

out_coin: ERC20 = COLLATERAL_TOKEN

in_precision: uint256 = BORROWED_PRECISION

out_precision: uint256 = COLLATERAL_PRECISION

if i == 1:

in_precision = out_precision

in_coin = out_coin

out_precision = BORROWED_PRECISION

out_coin = BORROWED_TOKEN

out: DetailedTrade = empty(DetailedTrade)

if use_in_amount:

out = self.calc_swap_out(i == 0, amount * in_precision, p_o, in_precision, out_precision)

else:

amount_to_swap: uint256 = max_value(uint256)

if amount < amount_to_swap:

amount_to_swap = amount * out_precision

out = self.calc_swap_in(i == 0, amount_to_swap, p_o, in_precision, out_precision)

in_amount_done: uint256 = unsafe_div(out.in_amount, in_precision)

out_amount_done: uint256 = unsafe_div(out.out_amount, out_precision)

if use_in_amount:

assert out_amount_done >= minmax_amount, "Slippage"

else:

assert in_amount_done <= minmax_amount and (out_amount_done == amount or amount == max_value(uint256)), "Slippage"

if out_amount_done == 0 or in_amount_done == 0:

return [0, 0]

out.admin_fee = unsafe_div(out.admin_fee, in_precision)

if i == 0:

self.admin_fees_x += out.admin_fee

else:

self.admin_fees_y += out.admin_fee

n: int256 = min(out.n1, out.n2)

n_start: int256 = n

n_diff: int256 = abs(unsafe_sub(out.n2, out.n1))

for k in range(MAX_TICKS):

x: uint256 = 0

y: uint256 = 0

if i == 0:

x = out.ticks_in[k]

if n == out.n2:

y = out.last_tick_j

else:

y = out.ticks_in[unsafe_sub(n_diff, k)]

if n == out.n2:

x = out.last_tick_j

self.bands_x[n] = x

self.bands_y[n] = y

if lm.address != empty(address):

s: uint256 = 0

if y > 0:

s = unsafe_div(y * 10**18, self.total_shares[n])

collateral_shares.append(s)

if k == n_diff:

break

n = unsafe_add(n, 1)

self.active_band = out.n2

log TokenExchange(_for, i, in_amount_done, j, out_amount_done)

if lm.address != empty(address):

lm.callback_collateral_shares(n_start, collateral_shares)

assert in_coin.transferFrom(msg.sender, self, in_amount_done, default_return_value=True)

assert out_coin.transfer(_for, out_amount_done, default_return_value=True)

return [in_amount_done, out_amount_done]

@internal

@view

def calc_swap_out(pump: bool, in_amount: uint256, p_o: uint256[2], in_precision: uint256, out_precision: uint256) -> DetailedTrade:

"""

@notice Calculate the amount which can be obtained as a result of exchange.

If couldn't exchange all - will also update the amount which was actually used.

Also returns other parameters related to state after swap.

This function is core to the AMM functionality.

@param pump Indicates whether the trade buys or sells collateral

@param in_amount Amount of token going in

@param p_o Current oracle price and ratio (p_o, dynamic_fee)

@return Amounts spent and given out, initial and final bands of the AMM, new

amounts of coins in bands in the AMM, as well as admin fee charged,

all in one data structure

"""

# pump = True: borrowable (USD) in, collateral (ETH) out; going up

# pump = False: collateral (ETH) in, borrowable (USD) out; going down

min_band: int256 = self.min_band

max_band: int256 = self.max_band

out: DetailedTrade = empty(DetailedTrade)

out.n2 = self.active_band

p_o_up: uint256 = self._p_oracle_up(out.n2)

x: uint256 = self.bands_x[out.n2]

y: uint256 = self.bands_y[out.n2]

in_amount_left: uint256 = in_amount

fee: uint256 = max(self.fee, p_o[1])

admin_fee: uint256 = self.admin_fee

j: uint256 = MAX_TICKS_UINT

for i in range(MAX_TICKS + MAX_SKIP_TICKS):

y0: uint256 = 0

f: uint256 = 0

g: uint256 = 0

Inv: uint256 = 0

dynamic_fee: uint256 = fee

if x > 0 or y > 0:

if j == MAX_TICKS_UINT:

out.n1 = out.n2

j = 0

y0 = self._get_y0(x, y, p_o[0], p_o_up) # <- also checks p_o

f = unsafe_div(A * y0 * p_o[0] / p_o_up * p_o[0], 10**18)

g = unsafe_div(Aminus1 * y0 * p_o_up, p_o[0])

Inv = (f + x) * (g + y)

dynamic_fee = max(self.get_dynamic_fee(p_o[0], p_o_up), fee)

antifee: uint256 = unsafe_div(

(10**18)**2,

unsafe_sub(10**18, min(dynamic_fee, 10**18 - 1))

)

if j != MAX_TICKS_UINT:

# Initialize

_tick: uint256 = y

if pump:

_tick = x

out.ticks_in.append(_tick)

# Need this to break if price is too far

p_ratio: uint256 = unsafe_div(p_o_up * 10**18, p_o[0])

if pump:

if y != 0:

if g != 0:

x_dest: uint256 = (unsafe_div(Inv, g) - f) - x

dx: uint256 = unsafe_div(x_dest * antifee, 10**18)

if dx >= in_amount_left:

# This is the last band

x_dest = unsafe_div(in_amount_left * 10**18, antifee) # LESS than in_amount_left

out.last_tick_j = min(Inv / (f + (x + x_dest)) - g + 1, y) # Should be always >= 0

x_dest = unsafe_div(unsafe_sub(in_amount_left, x_dest) * admin_fee, 10**18) # abs admin fee now

x += in_amount_left # x is precise after this

# Round down the output

out.out_amount += y - out.last_tick_j

out.ticks_in[j] = x - x_dest

out.in_amount = in_amount

out.admin_fee = unsafe_add(out.admin_fee, x_dest)

break

else:

# We go into the next band

dx = max(dx, 1) # Prevents from leaving dust in the band

x_dest = unsafe_div(unsafe_sub(dx, x_dest) * admin_fee, 10**18) # abs admin fee now

in_amount_left -= dx

out.ticks_in[j] = x + dx - x_dest

out.in_amount += dx

out.out_amount += y

out.admin_fee = unsafe_add(out.admin_fee, x_dest)

if i != MAX_TICKS + MAX_SKIP_TICKS - 1:

if out.n2 == max_band:

break

if j == MAX_TICKS_UINT - 1:

break

if p_ratio < unsafe_div(10**36, MAX_ORACLE_DN_POW):

# Don't allow to be away by more than ~50 ticks

break

out.n2 += 1

p_o_up = unsafe_div(p_o_up * Aminus1, A)

x = 0

y = self.bands_y[out.n2]

else: # dump

if x != 0:

if f != 0:

y_dest: uint256 = (unsafe_div(Inv, f) - g) - y

dy: uint256 = unsafe_div(y_dest * antifee, 10**18)

if dy >= in_amount_left:

# This is the last band

y_dest = unsafe_div(in_amount_left * 10**18, antifee)

out.last_tick_j = min(Inv / (g + (y + y_dest)) - f + 1, x)

y_dest = unsafe_div(unsafe_sub(in_amount_left, y_dest) * admin_fee, 10**18) # abs admin fee now

y += in_amount_left

out.out_amount += x - out.last_tick_j

out.ticks_in[j] = y - y_dest

out.in_amount = in_amount

out.admin_fee = unsafe_add(out.admin_fee, y_dest)

break

else:

# We go into the next band

dy = max(dy, 1) # Prevents from leaving dust in the band

y_dest = unsafe_div(unsafe_sub(dy, y_dest) * admin_fee, 10**18) # abs admin fee now

in_amount_left -= dy

out.ticks_in[j] = y + dy - y_dest

out.in_amount += dy

out.out_amount += x

out.admin_fee = unsafe_add(out.admin_fee, y_dest)

if i != MAX_TICKS + MAX_SKIP_TICKS - 1:

if out.n2 == min_band:

break

if j == MAX_TICKS_UINT - 1:

break

if p_ratio > MAX_ORACLE_DN_POW:

# Don't allow to be away by more than ~50 ticks

break

out.n2 -= 1

p_o_up = unsafe_div(p_o_up * A, Aminus1)

x = self.bands_x[out.n2]

y = 0

if j != MAX_TICKS_UINT:

j = unsafe_add(j, 1)

# Round up what goes in and down what goes out

# ceil(in_amount_used/BORROWED_PRECISION) * BORROWED_PRECISION

out.in_amount = unsafe_mul(unsafe_div(unsafe_add(out.in_amount, unsafe_sub(in_precision, 1)), in_precision), in_precision)

out.out_amount = unsafe_mul(unsafe_div(out.out_amount, out_precision), out_precision)

return out

@internal

@view

def calc_swap_in(pump: bool, out_amount: uint256, p_o: uint256[2], in_precision: uint256, out_precision: uint256) -> DetailedTrade:

"""

@notice Calculate the input amount required to receive the desired output amount.

If couldn't exchange all - will also update the amount which was actually received.

Also returns other parameters related to state after swap.

@param pump Indicates whether the trade buys or sells collateral

@param out_amount Desired amount of token going out

@param p_o Current oracle price and antisandwich fee (p_o, dynamic_fee)

@return Amounts required and given out, initial and final bands of the AMM, new

amounts of coins in bands in the AMM, as well as admin fee charged,

all in one data structure

"""

# pump = True: borrowable (USD) in, collateral (ETH) out; going up

# pump = False: collateral (ETH) in, borrowable (USD) out; going down

min_band: int256 = self.min_band

max_band: int256 = self.max_band

out: DetailedTrade = empty(DetailedTrade)

out.n2 = self.active_band

p_o_up: uint256 = self._p_oracle_up(out.n2)

x: uint256 = self.bands_x[out.n2]

y: uint256 = self.bands_y[out.n2]

out_amount_left: uint256 = out_amount

fee: uint256 = max(self.fee, p_o[1])

admin_fee: uint256 = self.admin_fee

j: uint256 = MAX_TICKS_UINT

for i in range(MAX_TICKS + MAX_SKIP_TICKS):

y0: uint256 = 0

f: uint256 = 0

g: uint256 = 0

Inv: uint256 = 0

dynamic_fee: uint256 = fee

if x > 0 or y > 0:

if j == MAX_TICKS_UINT:

out.n1 = out.n2

j = 0

y0 = self._get_y0(x, y, p_o[0], p_o_up) # <- also checks p_o

f = unsafe_div(A * y0 * p_o[0] / p_o_up * p_o[0], 10**18)

g = unsafe_div(Aminus1 * y0 * p_o_up, p_o[0])

Inv = (f + x) * (g + y)

dynamic_fee = max(self.get_dynamic_fee(p_o[0], p_o_up), fee)

antifee: uint256 = unsafe_div(

(10**18)**2,

unsafe_sub(10**18, min(dynamic_fee, 10**18 - 1))

)

if j != MAX_TICKS_UINT:

# Initialize

_tick: uint256 = y

if pump:

_tick = x

out.ticks_in.append(_tick)

# Need this to break if price is too far

p_ratio: uint256 = unsafe_div(p_o_up * 10**18, p_o[0])

if pump:

if y != 0:

if g != 0:

if y >= out_amount_left:

# This is the last band

out.last_tick_j = unsafe_sub(y, out_amount_left)

x_dest: uint256 = Inv / (g + out.last_tick_j) - f - x

dx: uint256 = unsafe_div(x_dest * antifee, 10**18) # MORE than x_dest

out.out_amount = out_amount # We successfully found liquidity for all the out_amount

out.in_amount += dx

x_dest = unsafe_div(unsafe_sub(dx, x_dest) * admin_fee, 10**18) # abs admin fee now

out.ticks_in[j] = x + dx - x_dest

out.admin_fee = unsafe_add(out.admin_fee, x_dest)

break

else:

# We go into the next band

x_dest: uint256 = (unsafe_div(Inv, g) - f) - x

dx: uint256 = max(unsafe_div(x_dest * antifee, 10**18), 1)

out_amount_left -= y

out.in_amount += dx

out.out_amount += y

x_dest = unsafe_div(unsafe_sub(dx, x_dest) * admin_fee, 10**18) # abs admin fee now

out.ticks_in[j] = x + dx - x_dest

out.admin_fee = unsafe_add(out.admin_fee, x_dest)

if i != MAX_TICKS + MAX_SKIP_TICKS - 1:

if out.n2 == max_band:

break

if j == MAX_TICKS_UINT - 1:

break

if p_ratio < unsafe_div(10**36, MAX_ORACLE_DN_POW):

# Don't allow to be away by more than ~50 ticks

break

out.n2 += 1

p_o_up = unsafe_div(p_o_up * Aminus1, A)

x = 0

y = self.bands_y[out.n2]

else: # dump

if x != 0:

if f != 0:

if x >= out_amount_left:

# This is the last band

out.last_tick_j = unsafe_sub(x, out_amount_left)

y_dest: uint256 = Inv / (f + out.last_tick_j) - g - y

dy: uint256 = unsafe_div(y_dest * antifee, 10**18) # MORE than y_dest

out.out_amount = out_amount

out.in_amount += dy

y_dest = unsafe_div(unsafe_sub(dy, y_dest) * admin_fee, 10**18) # abs admin fee now

out.ticks_in[j] = y + dy - y_dest

out.admin_fee = unsafe_add(out.admin_fee, y_dest)

break

else:

# We go into the next band

y_dest: uint256 = (unsafe_div(Inv, f) - g) - y

dy: uint256 = max(unsafe_div(y_dest * antifee, 10**18), 1)

out_amount_left -= x

out.in_amount += dy

out.out_amount += x

y_dest = unsafe_div(unsafe_sub(dy, y_dest) * admin_fee, 10**18) # abs admin fee now

out.ticks_in[j] = y + dy - y_dest

out.admin_fee = unsafe_add(out.admin_fee, y_dest)

if i != MAX_TICKS + MAX_SKIP_TICKS - 1:

if out.n2 == min_band:

break

if j == MAX_TICKS_UINT - 1:

break

if p_ratio > MAX_ORACLE_DN_POW:

# Don't allow to be away by more than ~50 ticks

break

out.n2 -= 1

p_o_up = unsafe_div(p_o_up * A, Aminus1)

x = self.bands_x[out.n2]

y = 0

if j != MAX_TICKS_UINT:

j = unsafe_add(j, 1)

# Round up what goes in and down what goes out

# ceil(in_amount_used/BORROWED_PRECISION) * BORROWED_PRECISION

out.in_amount = unsafe_mul(unsafe_div(unsafe_add(out.in_amount, unsafe_sub(in_precision, 1)), in_precision), in_precision)

out.out_amount = unsafe_mul(unsafe_div(out.out_amount, out_precision), out_precision)

return out

get_dy¶

AMM.get_dy(i: uint256, j: uint256, in_amount: uint256) -> uint256:

Function to calculate the amount of output tokens j to receive when exchanging in_amount of input token i.

Returns: out amount (uint256).

| Input | Type | Description |

|---|---|---|

i | uint256 | Input coin index. |

j | uint256 | Output coin index. |

in_amount | uint256 | Amount of input coin to swap. |

Source code

struct DetailedTrade:

in_amount: uint256

out_amount: uint256

n1: int256

n2: int256

ticks_in: DynArray[uint256, MAX_TICKS_UINT]

last_tick_j: uint256

admin_fee: uint256

@external

@view

@nonreentrant('lock')

def get_dy(i: uint256, j: uint256, in_amount: uint256) -> uint256:

"""

@notice Method to use to calculate out amount

@param i Input coin index

@param j Output coin index

@param in_amount Amount of input coin to swap

@return Amount of coin j to give out

"""

return self._get_dxdy(i, j, in_amount, True).out_amount

@internal

@view

def _get_dxdy(i: uint256, j: uint256, amount: uint256, is_in: bool) -> DetailedTrade:

"""

@notice Method to use to calculate out amount and spent in amount

@param i Input coin index

@param j Output coin index

@param amount Amount of input or output coin to swap

@param is_in Whether IN our OUT amount is known

@return DetailedTrade with all swap results

"""

# i = 0: borrowable (USD) in, collateral (ETH) out; going up

# i = 1: collateral (ETH) in, borrowable (USD) out; going down

assert (i == 0 and j == 1) or (i == 1 and j == 0), "Wrong index"

out: DetailedTrade = empty(DetailedTrade)

if amount == 0:

return out

in_precision: uint256 = COLLATERAL_PRECISION

out_precision: uint256 = BORROWED_PRECISION

if i == 0:

in_precision = BORROWED_PRECISION

out_precision = COLLATERAL_PRECISION

p_o: uint256[2] = self._price_oracle_ro()

if is_in:

out = self.calc_swap_out(i == 0, amount * in_precision, p_o, in_precision, out_precision)

else:

out = self.calc_swap_in(i == 0, amount * out_precision, p_o, in_precision, out_precision)

out.in_amount = unsafe_div(out.in_amount, in_precision)

out.out_amount = unsafe_div(out.out_amount, out_precision)

return out

get_dxdy¶

AMM.get_dxdy(i: uint256, j: uint256, in_amount: uint256) -> (uint256, uint256):

Function to calculate out_amount and in_amount spent.

Returns: in and out amount (uint256).

| Input | Type | Description |

|---|---|---|

i | uint256 | Input coin index. |

j | uint256 | Output coin index. |

in_amount | uint256 | Amount of input coin to swap. |

Source code

struct DetailedTrade:

in_amount: uint256

out_amount: uint256

n1: int256

n2: int256

ticks_in: DynArray[uint256, MAX_TICKS_UINT]

last_tick_j: uint256

admin_fee: uint256

@external

@view

@nonreentrant('lock')

def get_dxdy(i: uint256, j: uint256, in_amount: uint256) -> (uint256, uint256):

"""

@notice Method to use to calculate out amount and spent in amount

@param i Input coin index

@param j Output coin index

@param in_amount Amount of input coin to swap

@return A tuple with in_amount used and out_amount returned

"""

out: DetailedTrade = self._get_dxdy(i, j, in_amount, True)

return (out.in_amount, out.out_amount)

@internal

@view

def _get_dxdy(i: uint256, j: uint256, amount: uint256, is_in: bool) -> DetailedTrade:

"""

@notice Method to use to calculate out amount and spent in amount

@param i Input coin index

@param j Output coin index

@param amount Amount of input or output coin to swap

@param is_in Whether IN our OUT amount is known

@return DetailedTrade with all swap results

"""

# i = 0: borrowable (USD) in, collateral (ETH) out; going up

# i = 1: collateral (ETH) in, borrowable (USD) out; going down

assert (i == 0 and j == 1) or (i == 1 and j == 0), "Wrong index"

out: DetailedTrade = empty(DetailedTrade)

if amount == 0:

return out

in_precision: uint256 = COLLATERAL_PRECISION

out_precision: uint256 = BORROWED_PRECISION

if i == 0:

in_precision = BORROWED_PRECISION

out_precision = COLLATERAL_PRECISION

p_o: uint256[2] = self._price_oracle_ro()

if is_in:

out = self.calc_swap_out(i == 0, amount * in_precision, p_o, in_precision, out_precision)

else:

out = self.calc_swap_in(i == 0, amount * out_precision, p_o, in_precision, out_precision)

out.in_amount = unsafe_div(out.in_amount, in_precision)

out.out_amount = unsafe_div(out.out_amount, out_precision)

return out

get_dx¶

AMM.get_dx(i: uint256, j: uint256, out_amount: uint256) -> uint256:

Function to calculate the in_amount of token i required to receive out_amount of token j.

Returns: in amount (uint256).

| Input | Type | Description |

|---|---|---|

i | uint256 | Input coin index. |

j | uint256 | Output coin index. |

out_amount | uint256 | Desired amount of output coin to receive. |

Source code

struct DetailedTrade:

in_amount: uint256

out_amount: uint256

n1: int256

n2: int256

ticks_in: DynArray[uint256, MAX_TICKS_UINT]

last_tick_j: uint256

admin_fee: uint256

@external

@view

@nonreentrant('lock')

def get_dx(i: uint256, j: uint256, out_amount: uint256) -> uint256:

"""

@notice Method to use to calculate in amount required to receive the desired out_amount

@param i Input coin index

@param j Output coin index

@param out_amount Desired amount of output coin to receive

@return Amount of coin i to spend

"""

# i = 0: borrowable (USD) in, collateral (ETH) out; going up

# i = 1: collateral (ETH) in, borrowable (USD) out; going down

trade: DetailedTrade = self._get_dxdy(i, j, out_amount, False)

assert trade.out_amount == out_amount

return trade.in_amount

@internal

@view

def _get_dxdy(i: uint256, j: uint256, amount: uint256, is_in: bool) -> DetailedTrade:

"""

@notice Method to use to calculate out amount and spent in amount

@param i Input coin index

@param j Output coin index

@param amount Amount of input or output coin to swap

@param is_in Whether IN our OUT amount is known

@return DetailedTrade with all swap results

"""

# i = 0: borrowable (USD) in, collateral (ETH) out; going up

# i = 1: collateral (ETH) in, borrowable (USD) out; going down

assert (i == 0 and j == 1) or (i == 1 and j == 0), "Wrong index"

out: DetailedTrade = empty(DetailedTrade)

if amount == 0:

return out

in_precision: uint256 = COLLATERAL_PRECISION

out_precision: uint256 = BORROWED_PRECISION

if i == 0:

in_precision = BORROWED_PRECISION

out_precision = COLLATERAL_PRECISION

p_o: uint256[2] = self._price_oracle_ro()

if is_in:

out = self.calc_swap_out(i == 0, amount * in_precision, p_o, in_precision, out_precision)

else:

out = self.calc_swap_in(i == 0, amount * out_precision, p_o, in_precision, out_precision)

out.in_amount = unsafe_div(out.in_amount, in_precision)

out.out_amount = unsafe_div(out.out_amount, out_precision)

return out

get_dydx¶

AMM.get_dydx(i: uint256, j: uint256, out_amount: uint256) -> (uint256, uint256):

Function to calculate the in_amount required and out_amount received.

Returns: out and in amount (uint256).|

| Input | Type | Description |

|---|---|---|

i | uint256 | Input coin index. |

j | uint256 | Output coin index. |

out_amount | uint256 | Desired amount of output coin to receive. |

Source code

struct DetailedTrade:

in_amount: uint256

out_amount: uint256

n1: int256

n2: int256

ticks_in: DynArray[uint256, MAX_TICKS_UINT]

last_tick_j: uint256

admin_fee: uint256

@external

@view

@nonreentrant('lock')

def get_dydx(i: uint256, j: uint256, out_amount: uint256) -> (uint256, uint256):

"""

@notice Method to use to calculate in amount required and out amount received

@param i Input coin index

@param j Output coin index

@param out_amount Desired amount of output coin to receive

@return A tuple with out_amount received and in_amount returned

"""

# i = 0: borrowable (USD) in, collateral (ETH) out; going up

# i = 1: collateral (ETH) in, borrowable (USD) out; going down

out: DetailedTrade = self._get_dxdy(i, j, out_amount, False)

return (out.out_amount, out.in_amount)

@internal

@view

def _get_dxdy(i: uint256, j: uint256, amount: uint256, is_in: bool) -> DetailedTrade:

"""

@notice Method to use to calculate out amount and spent in amount

@param i Input coin index

@param j Output coin index

@param amount Amount of input or output coin to swap

@param is_in Whether IN our OUT amount is known

@return DetailedTrade with all swap results

"""

# i = 0: borrowable (USD) in, collateral (ETH) out; going up

# i = 1: collateral (ETH) in, borrowable (USD) out; going down

assert (i == 0 and j == 1) or (i == 1 and j == 0), "Wrong index"

out: DetailedTrade = empty(DetailedTrade)

if amount == 0:

return out

in_precision: uint256 = COLLATERAL_PRECISION

out_precision: uint256 = BORROWED_PRECISION

if i == 0:

in_precision = BORROWED_PRECISION

out_precision = COLLATERAL_PRECISION

p_o: uint256[2] = self._price_oracle_ro()

if is_in:

out = self.calc_swap_out(i == 0, amount * in_precision, p_o, in_precision, out_precision)

else:

out = self.calc_swap_in(i == 0, amount * out_precision, p_o, in_precision, out_precision)

out.in_amount = unsafe_div(out.in_amount, in_precision)

out.out_amount = unsafe_div(out.out_amount, out_precision)

return out

get_amount_for_price¶

AMM.get_amount_for_price(p: uint256) -> (uint256, bool):

Function to calculate the necessary amount to be exchanged to have the AMM at the final price p.

Returns: amount to exchange (uint256) and true or false (bool). The returned bool reflects whether the exchange "pumps" the collateral price or "dumps" it. True reflects the need to buy the collateral token with crvUSD in order to reach the final price p, and False vice versa.

| Input | Type | Description |

|---|---|---|

p | uint256 | Price of the AMM. |

Source code

@external

@view

@nonreentrant('lock')

def get_amount_for_price(p: uint256) -> (uint256, bool):

"""

@notice Amount necessary to be exchanged to have the AMM at the final price `p`

@return (amount, is_pump)

"""

min_band: int256 = self.min_band

max_band: int256 = self.max_band

n: int256 = self.active_band

p_o: uint256[2] = self._price_oracle_ro()

p_o_up: uint256 = self._p_oracle_up(n)

p_down: uint256 = unsafe_div(unsafe_div(p_o[0]**2, p_o_up) * p_o[0], p_o_up) # p_current_down

p_up: uint256 = unsafe_div(p_down * A2, Aminus12) # p_crurrent_up

amount: uint256 = 0

y0: uint256 = 0

f: uint256 = 0

g: uint256 = 0

Inv: uint256 = 0

j: uint256 = MAX_TICKS_UINT

pump: bool = True

for i in range(MAX_TICKS + MAX_SKIP_TICKS):

assert p_o_up > 0

x: uint256 = self.bands_x[n]

y: uint256 = self.bands_y[n]

if i == 0:

if p < self._get_p(n, x, y):

pump = False

not_empty: bool = x > 0 or y > 0

if not_empty:

y0 = self._get_y0(x, y, p_o[0], p_o_up)

f = unsafe_div(unsafe_div(A * y0 * p_o[0], p_o_up) * p_o[0], 10**18)

g = unsafe_div(Aminus1 * y0 * p_o_up, p_o[0])

Inv = (f + x) * (g + y)

if j == MAX_TICKS_UINT:

j = 0

if p <= p_up:

if p >= p_down:

if not_empty:

ynew: uint256 = unsafe_sub(max(self.sqrt_int(Inv * 10**18 / p), g), g)

xnew: uint256 = unsafe_sub(max(Inv / (g + ynew), f), f)

if pump:

amount += unsafe_sub(max(xnew, x), x)

else:

amount += unsafe_sub(max(ynew, y), y)

break

# Need this to break if price is too far

p_ratio: uint256 = unsafe_div(p_o_up * 10**18, p_o[0])

if pump:

if not_empty:

amount += (Inv / g - f) - x

if n == max_band:

break

if j == MAX_TICKS_UINT - 1:

break

if p_ratio < unsafe_div(10**36, MAX_ORACLE_DN_POW):

# Don't allow to be away by more than ~50 ticks

break

n += 1

p_down = p_up

p_up = unsafe_div(p_up * A2, Aminus12)

p_o_up = unsafe_div(p_o_up * Aminus1, A)

else:

if not_empty:

amount += (Inv / f - g) - y

if n == min_band:

break

if j == MAX_TICKS_UINT - 1:

break

if p_ratio > MAX_ORACLE_DN_POW:

# Don't allow to be away by more than ~50 ticks

break

n -= 1

p_up = p_down

p_down = unsafe_div(p_down * Aminus12, A2)

p_o_up = unsafe_div(p_o_up * A, Aminus1)

if j != MAX_TICKS_UINT:

j = unsafe_add(j, 1)

amount = amount * 10**18 / unsafe_sub(10**18, max(self.fee, p_o[1]))

if amount == 0:

return 0, pump

# Precision and round up

if pump:

amount = unsafe_add(unsafe_div(unsafe_sub(amount, 1), BORROWED_PRECISION), 1)

else:

amount = unsafe_add(unsafe_div(unsafe_sub(amount, 1), COLLATERAL_PRECISION), 1)

return amount, pump

>>> Controller.amm_price(42360604244534725358731)

42360604244534725358731

>>> AMM.get_amount_for_price(42360604244534725358731)

(0, True) # value is 0, because we already are at the current amm price

>>> AMM.get_amount_for_price(43500000000000000000000)

(33883533434143618564545, True) # need to sell crvusd for tbtc to get the price up

>>> AMM.get_amount_for_price(41500000000000000000000)

(648390479703549124, False) # need to sell tbtc for crvusd to get the price down

Note

bool = true -> need to exchange crvUSD for collateral (to get the price of the collateral UP)

bool = false -> need to exchange collateral for crvUSD (to get the price of the collateral DOWN)

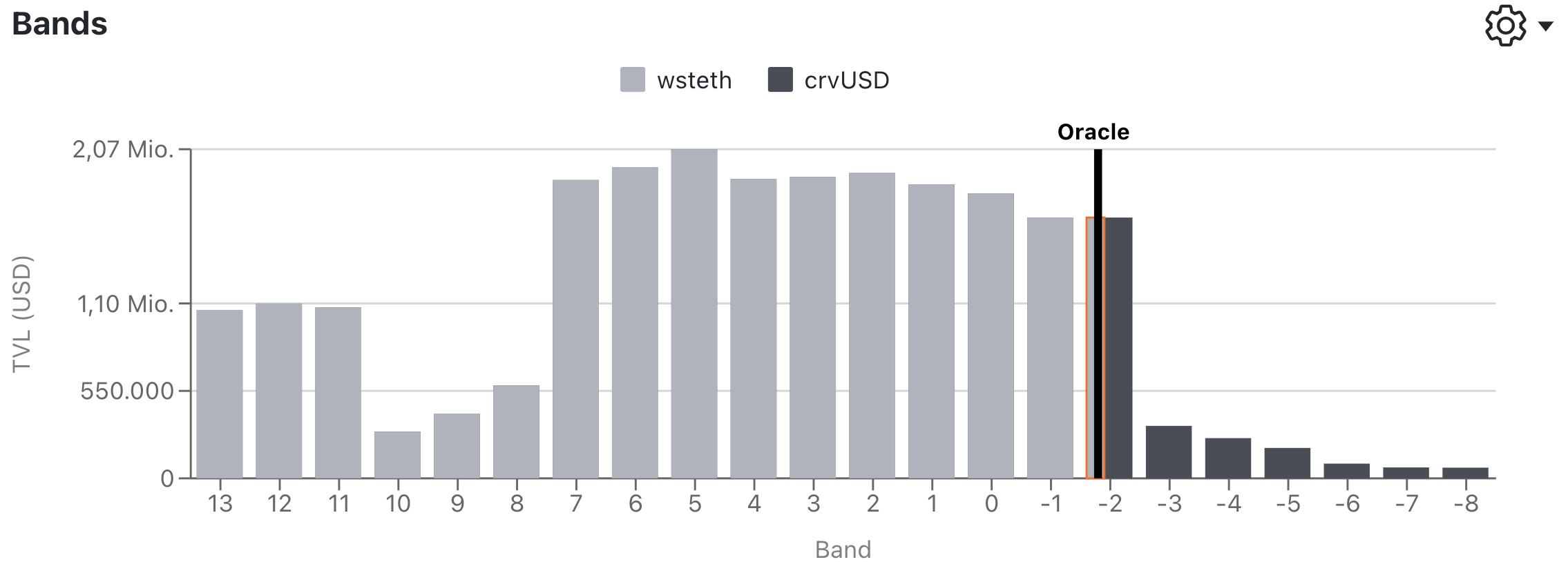

Bands¶

"Each band works like Uniswap V3, concentrating liquidity between two prices, and being all in the collateral at the lower price and all in crvUSD at the higher price. However since the entire interval of prices are aggressively placed with respect to the market (higher than oracle price when it's moving up and lower when it's moving down), each band gets arbed to hold all of either collateral or stablecoin in the opposite manner than expected when LP-ing with Uniswap V3."2

Each individual band has an upper (p_oracle_up) and lower (p_oracle_down) price bound. These prices are not actual AMM prices, but rather thresholds for the bands.

Therefore, because it is a continuous grid, the lower price bound of, let's say, band 0 is the same as the upper price bound of band 1.

There are three possible compositions of bands:

active_bandconsists of both the borrowable and collateral asset, depending on the oracle price within the band- Bands <

active_band: fully in borrowable asset as the bands above have already gone through soft-liquidation - Bands >

active_band: fully in the collateral asset as the bands have not been in soft-liquidation mode

In the code, x represents the borrowable token, and y the collateral token.

A¶

AMM.A() -> uint256: view

Getter for A (amplicitation coefficient). The amplication defines the density of the liquidty and band size. The relative band size is \(\frac{1}{A}\).

Returns: amplification coefficient (uint256).

Source code

A: public(immutable(uint256))

@external

def __init__(

_borrowed_token: address,

_borrowed_precision: uint256,

_collateral_token: address,

_collateral_precision: uint256,

_A: uint256,

_sqrt_band_ratio: uint256,

_log_A_ratio: int256,

_base_price: uint256,

fee: uint256,

admin_fee: uint256,

_price_oracle_contract: address,

):

"""

@notice LLAMMA constructor

@param _borrowed_token Token which is being borrowed

@param _collateral_token Token used as collateral

@param _collateral_precision Precision of collateral: we pass it because we want the blueprint to fit into bytecode

@param _A "Amplification coefficient" which also defines density of liquidity and band size. Relative band size is 1/_A

@param _sqrt_band_ratio Precomputed int(sqrt(A / (A - 1)) * 1e18)

@param _log_A_ratio Precomputed int(ln(A / (A - 1)) * 1e18)

@param _base_price Typically the initial crypto price at which AMM is deployed. Will correspond to band 0

@param fee Relative fee of the AMM: int(fee * 1e18)

@param admin_fee Admin fee: how much of fee goes to admin. 50% === int(0.5 * 1e18)

@param _price_oracle_contract External price oracle which has price() and price_w() methods

which both return current price of collateral multiplied by 1e18

"""

...

A = _A

...

active_band¶

AMM.active_band() -> int256: view

Getter for the current active band, the band in which get_p currently is in. Other bands are either in one or the other coin, but not in both. Upper bands are in the borrowable token, lower bands in the collateral token.

Returns: active band (int256).

min_band¶

AMM.min_band() -> int256: view

Getter for the minimum band. All bands below this one are definitely empty.

Returns: minimum band (int256).

max_band¶

AMM.max_band() -> int256: view

Getter for the maximum band. All bands above this one are definitely empty.

Returns: maximum band (int256).

has_liquidity¶

AMM.has_liquidity(user_: address) -> bool:

Function to check if user has any liquidity in the AMM.

Returns: true or false (bool).

| Input | Type | Description |

|---|---|---|

user | address | User Address. |

Source code

bands_x¶

AMM.bands_x(arg0: int256) -> uint256: view

Getter for the amount of the borrowable token deposited in band number arg0.

Returns: token amount (uint256).

| Input | Type | Description |

|---|---|---|

arg0 | int256 | Number of the band. |

Note

At the time of creating these examples, active_band was -48. Band -48 consists of the borrowable and collateral token. All bands below fully in the borrowable token, and all bands above fully in the collateral token.

bands_y¶

AMM.bands_y(arg0: int256) -> uint256: view

Getter for the amount of collateral token deposited in band number arg0.

Returns: amount (uint256) of coin y deposited in a band.

| Input | Type | Description |

|---|---|---|

arg0 | int256 | Band |

Note

At the time of creating these examples, active_band was -48. Band -48 consists of the borrowable and collateral token. All bands below fully in the borrowable token, and all bands above fully in the collateral token.

get_xy¶

AMM.get_xy(user: address) -> DynArray[uint256, MAX_TICKS_UINT][2]:

Function to measure balances of the borrowed and collateral assets across the different bands for user.

Returns: balances of borrowed and collateral token (uint256) in the different bands.

| Input | Type | Description |

|---|---|---|

user | address | User address |

Source code

@external

@view

@nonreentrant('lock')

def get_xy(user: address) -> DynArray[uint256, MAX_TICKS_UINT][2]:

"""

@notice A low-gas function to measure amounts of stablecoins and collateral by bands which user currently owns

@param user User address

@return Amounts of (stablecoin, collateral) by bands in a tuple

"""

return self._get_xy(user, False)

@internal

@view

def _get_xy(user: address, is_sum: bool) -> DynArray[uint256, MAX_TICKS_UINT][2]:

"""

@notice A low-gas function to measure amounts of stablecoins and collateral which user currently owns

@param user User address

@param is_sum Return sum or amounts by bands

@return Amounts of (stablecoin, collateral) in a tuple

"""

xs: DynArray[uint256, MAX_TICKS_UINT] = []

ys: DynArray[uint256, MAX_TICKS_UINT] = []

if is_sum:

xs.append(0)

ys.append(0)

ns: int256[2] = self._read_user_tick_numbers(user)

ticks: DynArray[uint256, MAX_TICKS_UINT] = self._read_user_ticks(user, ns)

if ticks[0] != 0:

for i in range(MAX_TICKS):

total_shares: uint256 = self.total_shares[ns[0]] + DEAD_SHARES

ds: uint256 = ticks[i]

dx: uint256 = unsafe_div((self.bands_x[ns[0]] + 1) * ds, total_shares)

dy: uint256 = unsafe_div((self.bands_y[ns[0]] + 1) * ds, total_shares)

if is_sum:

xs[0] += dx

ys[0] += dy

else:

xs.append(unsafe_div(dx, BORROWED_PRECISION))

ys.append(unsafe_div(dy, COLLATERAL_PRECISION))

if ns[0] == ns[1]:

break

ns[0] = unsafe_add(ns[0], 1)

if is_sum:

xs[0] = unsafe_div(xs[0], BORROWED_PRECISION)

ys[0] = unsafe_div(ys[0], COLLATERAL_PRECISION)

return [xs, ys]

>>> AMM.get_xy(trader)

[[0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0],

[33333333333333343, 33333333333333333, 33333333333333333, 33333333333333333, 33333333333333333, 33333333333333333, 33333333333333333, 33333333333333333, 33333333333333333, 33333333333333333, 33333333333333333, 33333333333333333, 33333333333333333, 33333333333333333, 33333333333333333, 33333333333333333, 33333333333333333, 33333333333333333, 33333333333333333, 33333333333333333, 33333333333333333, 33333333333333333, 33333333333333333, 33333333333333333, 33333333333333333, 33333333333333333, 33333333333333333, 33333333333333333, 33333333333333333, 33333333333333333]]

read_user_tick_numbers¶

AMM.read_user_tick_numbers(user: address) -> int256[2]:

Function to unpack and read the user's tick numbers (= lowest and highest band the user deposited into).

Returns: upper and lower band (int256).

| Input | Type | Description |

|---|---|---|

user | address | User address. |

Source code

user_shares: HashMap[address, UserTicks]

@external

@view

@nonreentrant('lock')

def read_user_tick_numbers(user: address) -> int256[2]:

"""

@notice Unpacks and reads user tick numbers

@param user User address

@return Lowest and highest band the user deposited into

"""

return self._read_user_tick_numbers(user)

@internal

@view

def _read_user_tick_numbers(user: address) -> int256[2]:

"""

@notice Unpacks and reads user tick numbers

@param user User address

@return Lowest and highest band the user deposited into

"""

ns: int256 = self.user_shares[user].ns

n2: int256 = unsafe_div(ns, 2**128)

n1: int256 = ns % 2**128

if n1 >= 2**127:

n1 = unsafe_sub(n1, 2**128)

n2 = unsafe_add(n2, 1)

return [n1, n2]

get_y_up¶

AMM.get_y_up(user: address) -> uint256:

Function to measure the amount of y (collateral token) in band n for user if we adiabatically trade near p_oracle on the way up.

Returns: amount of collateral (uint256).

| Input | Type | Description |

|---|---|---|

user | address | User address. |

Source code

@external

@view

@nonreentrant('lock')

def get_y_up(user: address) -> uint256:

"""

@notice Measure the amount of y (collateral) in the band n if we adiabatically trade near p_oracle on the way up

@param user User the amount is calculated for

@return Amount of coins

"""

return self.get_xy_up(user, True)

@internal

@view

def get_xy_up(user: address, use_y: bool) -> uint256:

"""

@notice Measure the amount of y (collateral) in the band n if we adiabatically trade near p_oracle on the way up,

or the amount of x (stablecoin) if we trade adiabatically down

@param user User the amount is calculated for

@param use_y Calculate amount of collateral if True and of stablecoin if False

@return Amount of coins

"""

ns: int256[2] = self._read_user_tick_numbers(user)

ticks: DynArray[uint256, MAX_TICKS_UINT] = self._read_user_ticks(user, ns)

if ticks[0] == 0: # Even dynamic array will have 0th element set here

return 0

p_o: uint256 = self._price_oracle_ro()[0]

assert p_o != 0

n: int256 = ns[0] - 1

n_active: int256 = self.active_band

p_o_down: uint256 = self._p_oracle_up(ns[0])

XY: uint256 = 0

for i in range(MAX_TICKS):

n += 1

if n > ns[1]:

break

x: uint256 = 0

y: uint256 = 0

if n >= n_active:

y = self.bands_y[n]

if n <= n_active:

x = self.bands_x[n]

# p_o_up: uint256 = self._p_oracle_up(n)

p_o_up: uint256 = p_o_down

# p_o_down = self._p_oracle_up(n + 1)

p_o_down = unsafe_div(p_o_down * Aminus1, A)

if x == 0:

if y == 0:

continue

total_share: uint256 = self.total_shares[n]

user_share: uint256 = ticks[i]

if total_share == 0:

continue

if user_share == 0:

continue

total_share += DEAD_SHARES

# Also ideally we'd want to add +1 to all quantities when calculating with shares

# but we choose to save bytespace and slightly under-estimate the result of this call

# which is also more conservative

# Also this will revert if p_o_down is 0, and p_o_down is 0 if p_o_up is 0

p_current_mid: uint256 = unsafe_div(p_o**2 / p_o_down * p_o, p_o_up)

# if p_o > p_o_up - we "trade" everything to y and then convert to the result

# if p_o < p_o_down - "trade" to x, then convert to result

# otherwise we are in-band, so we do the more complex logic to trade

# to p_o rather than to the edge of the band

# trade to the edge of the band == getting to the band edge while p_o=const

# Cases when special conversion is not needed (to save on computations)

if x == 0 or y == 0:

if p_o > p_o_up: # p_o < p_current_down

# all to y at constant p_o, then to target currency adiabatically

y_equiv: uint256 = y

if y == 0:

y_equiv = x * 10**18 / p_current_mid

if use_y:

XY += unsafe_div(y_equiv * user_share, total_share)

else:

XY += unsafe_div(unsafe_div(y_equiv * p_o_up, SQRT_BAND_RATIO) * user_share, total_share)

continue

elif p_o < p_o_down: # p_o > p_current_up

# all to x at constant p_o, then to target currency adiabatically

x_equiv: uint256 = x

if x == 0:

x_equiv = unsafe_div(y * p_current_mid, 10**18)

if use_y:

XY += unsafe_div(unsafe_div(x_equiv * SQRT_BAND_RATIO, p_o_up) * user_share, total_share)

else:

XY += unsafe_div(x_equiv * user_share, total_share)

continue

# If we are here - we need to "trade" to somewhere mid-band

# So we need more heavy math

y0: uint256 = self._get_y0(x, y, p_o, p_o_up)

f: uint256 = unsafe_div(unsafe_div(A * y0 * p_o, p_o_up) * p_o, 10**18)

g: uint256 = unsafe_div(Aminus1 * y0 * p_o_up, p_o)

# (f + x)(g + y) = const = p_top * A**2 * y0**2 = I

Inv: uint256 = (f + x) * (g + y)

# p = (f + x) / (g + y) => p * (g + y)**2 = I or (f + x)**2 / p = I

# First, "trade" in this band to p_oracle

x_o: uint256 = 0

y_o: uint256 = 0

if p_o > p_o_up: # p_o < p_current_down, all to y

# x_o = 0

y_o = unsafe_sub(max(Inv / f, g), g)

if use_y:

XY += unsafe_div(y_o * user_share, total_share)

else:

XY += unsafe_div(unsafe_div(y_o * p_o_up, SQRT_BAND_RATIO) * user_share, total_share)

elif p_o < p_o_down: # p_o > p_current_up, all to x

# y_o = 0

x_o = unsafe_sub(max(Inv / g, f), f)

if use_y:

XY += unsafe_div(unsafe_div(x_o * SQRT_BAND_RATIO, p_o_up) * user_share, total_share)

else:

XY += unsafe_div(x_o * user_share, total_share)

else:

# Equivalent from Chainsecurity (which also has less numerical errors):

y_o = unsafe_div(A * y0 * unsafe_sub(p_o, p_o_down), p_o)

# x_o = unsafe_div(A * y0 * p_o, p_o_up) * unsafe_sub(p_o_up, p_o)

# Old math

# y_o = unsafe_sub(max(self.sqrt_int(unsafe_div(Inv * 10**18, p_o)), g), g)

x_o = unsafe_sub(max(Inv / (g + y_o), f), f)

# Now adiabatic conversion from definitely in-band

if use_y:

XY += unsafe_div((y_o + x_o * 10**18 / self.sqrt_int(p_o_up * p_o)) * user_share, total_share)

else:

XY += unsafe_div((x_o + unsafe_div(y_o * self.sqrt_int(p_o_down * p_o), 10**18)) * user_share, total_share)

if use_y:

return unsafe_div(XY, COLLATERAL_PRECISION)

else:

return unsafe_div(XY, BORROWED_PRECISION)

get_x_down¶

AMM.get_x_down(user: address) -> uint256:

Function to measure the amount of x (borrowable token) in band n for user if we adiabatically trade down.

Returns: amount of collateral (uint256).

| Input | Type | Description |

|---|---|---|

user | address | User address. |

Source code

@external

@view

@nonreentrant('lock')

def get_x_down(user: address) -> uint256:

"""

@notice Measure the amount of x (stablecoin) if we trade adiabatically down

@param user User the amount is calculated for

@return Amount of coins

"""

return self.get_xy_up(user, False)

@internal

@view

def get_xy_up(user: address, use_y: bool) -> uint256:

"""

@notice Measure the amount of y (collateral) in the band n if we adiabatically trade near p_oracle on the way up,

or the amount of x (stablecoin) if we trade adiabatically down

@param user User the amount is calculated for

@param use_y Calculate amount of collateral if True and of stablecoin if False

@return Amount of coins

"""

ns: int256[2] = self._read_user_tick_numbers(user)

ticks: DynArray[uint256, MAX_TICKS_UINT] = self._read_user_ticks(user, ns)

if ticks[0] == 0: # Even dynamic array will have 0th element set here

return 0

p_o: uint256 = self._price_oracle_ro()[0]

assert p_o != 0

n: int256 = ns[0] - 1

n_active: int256 = self.active_band

p_o_down: uint256 = self._p_oracle_up(ns[0])

XY: uint256 = 0

for i in range(MAX_TICKS):

n += 1

if n > ns[1]:

break

x: uint256 = 0

y: uint256 = 0

if n >= n_active:

y = self.bands_y[n]

if n <= n_active:

x = self.bands_x[n]

# p_o_up: uint256 = self._p_oracle_up(n)

p_o_up: uint256 = p_o_down

# p_o_down = self._p_oracle_up(n + 1)

p_o_down = unsafe_div(p_o_down * Aminus1, A)

if x == 0:

if y == 0:

continue

total_share: uint256 = self.total_shares[n]

user_share: uint256 = ticks[i]

if total_share == 0:

continue

if user_share == 0:

continue

total_share += DEAD_SHARES

# Also ideally we'd want to add +1 to all quantities when calculating with shares

# but we choose to save bytespace and slightly under-estimate the result of this call

# which is also more conservative

# Also this will revert if p_o_down is 0, and p_o_down is 0 if p_o_up is 0

p_current_mid: uint256 = unsafe_div(p_o**2 / p_o_down * p_o, p_o_up)

# if p_o > p_o_up - we "trade" everything to y and then convert to the result

# if p_o < p_o_down - "trade" to x, then convert to result

# otherwise we are in-band, so we do the more complex logic to trade

# to p_o rather than to the edge of the band

# trade to the edge of the band == getting to the band edge while p_o=const

# Cases when special conversion is not needed (to save on computations)

if x == 0 or y == 0:

if p_o > p_o_up: # p_o < p_current_down

# all to y at constant p_o, then to target currency adiabatically

y_equiv: uint256 = y

if y == 0:

y_equiv = x * 10**18 / p_current_mid

if use_y:

XY += unsafe_div(y_equiv * user_share, total_share)

else:

XY += unsafe_div(unsafe_div(y_equiv * p_o_up, SQRT_BAND_RATIO) * user_share, total_share)

continue

elif p_o < p_o_down: # p_o > p_current_up

# all to x at constant p_o, then to target currency adiabatically

x_equiv: uint256 = x

if x == 0:

x_equiv = unsafe_div(y * p_current_mid, 10**18)

if use_y:

XY += unsafe_div(unsafe_div(x_equiv * SQRT_BAND_RATIO, p_o_up) * user_share, total_share)

else:

XY += unsafe_div(x_equiv * user_share, total_share)

continue

# If we are here - we need to "trade" to somewhere mid-band

# So we need more heavy math

y0: uint256 = self._get_y0(x, y, p_o, p_o_up)

f: uint256 = unsafe_div(unsafe_div(A * y0 * p_o, p_o_up) * p_o, 10**18)

g: uint256 = unsafe_div(Aminus1 * y0 * p_o_up, p_o)

# (f + x)(g + y) = const = p_top * A**2 * y0**2 = I

Inv: uint256 = (f + x) * (g + y)

# p = (f + x) / (g + y) => p * (g + y)**2 = I or (f + x)**2 / p = I

# First, "trade" in this band to p_oracle

x_o: uint256 = 0

y_o: uint256 = 0

if p_o > p_o_up: # p_o < p_current_down, all to y

# x_o = 0

y_o = unsafe_sub(max(Inv / f, g), g)

if use_y:

XY += unsafe_div(y_o * user_share, total_share)

else:

XY += unsafe_div(unsafe_div(y_o * p_o_up, SQRT_BAND_RATIO) * user_share, total_share)

elif p_o < p_o_down: # p_o > p_current_up, all to x

# y_o = 0

x_o = unsafe_sub(max(Inv / g, f), f)

if use_y:

XY += unsafe_div(unsafe_div(x_o * SQRT_BAND_RATIO, p_o_up) * user_share, total_share)

else:

XY += unsafe_div(x_o * user_share, total_share)

else:

# Equivalent from Chainsecurity (which also has less numerical errors):

y_o = unsafe_div(A * y0 * unsafe_sub(p_o, p_o_down), p_o)

# x_o = unsafe_div(A * y0 * p_o, p_o_up) * unsafe_sub(p_o_up, p_o)

# Old math

# y_o = unsafe_sub(max(self.sqrt_int(unsafe_div(Inv * 10**18, p_o)), g), g)

x_o = unsafe_sub(max(Inv / (g + y_o), f), f)

# Now adiabatic conversion from definitely in-band

if use_y:

XY += unsafe_div((y_o + x_o * 10**18 / self.sqrt_int(p_o_up * p_o)) * user_share, total_share)

else:

XY += unsafe_div((x_o + unsafe_div(y_o * self.sqrt_int(p_o_down * p_o), 10**18)) * user_share, total_share)

if use_y:

return unsafe_div(XY, COLLATERAL_PRECISION)

else:

return unsafe_div(XY, BORROWED_PRECISION)

can_skip_bands¶

AMM.can_skip_bands(n_end: int256) -> bool:

Function to check if there is liquidity between active_band and n_end.

Returns: true or false (bool).

| Input | Type | Description |

|---|---|---|

n_end | int256 | Band number to check until. |

Source code

@external

@view

@nonreentrant('lock')

def can_skip_bands(n_end: int256) -> bool:

"""